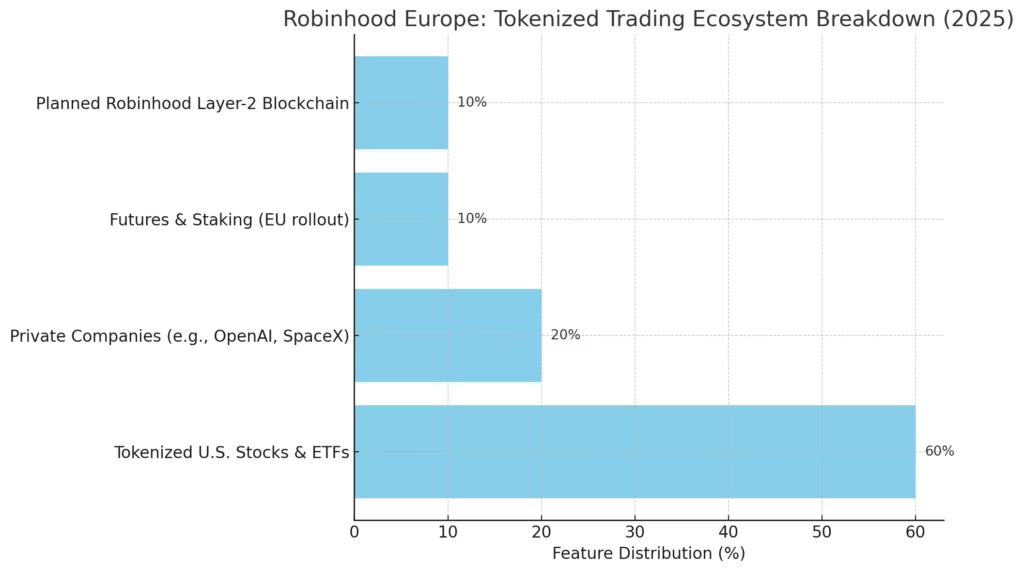

Robinhood has launched over 200 tokenized U.S. stocks and ETFs (plus private equity like SpaceX and OpenAI) in the EU—built on Arbitrum, offering commission-free, 24/5 trading, dividend payments, and plans for a native Layer‑2 blockchain.

“Tokenization is going to open the door to a massive trading revolution making it possible to own or fractionally own assets that were never accessible before.”

— Vlad Tenev, CEO, Robinhood (speaking at the Cannes “To Catch a Token” event).

🚀 Why It Matters

- Global democratization: EU investors gain access to top U.S. stocks (Apple, Microsoft, Nvidia) and private companies (OpenAI, SpaceX), with more tokenized assets planned by year-end.

- crypto-meets-Stocks: Built on Arbitrum, with plans for Robinhood-branded Layer‑2, enabling 24/5 trading, fast settlement, dividend receipts—even without voting rights.

- Market reaction: HOOD shares surged up to 13% following the rollout, with analysts calling it a “must-own” in crypto finance.

🔧 How It Works

- Robinhood buys a U.S. share via broker-dealers.

- Each stock is then “minted” into a token on Arbitrum (1 token = 1 share).

- EU users trade tokens commission-free, 24 hours a day, five days a week—dividends automatically credited.

- Robinhood plans to launch a proprietary Layer‑2 blockchain to enable true 24/7 trading in future.

🌍 Regional Positioning

- EU rollout launched across 30+ EU/EEA countries, extending Robinhood’s reach with crypto futures and staking simultaneously launched in the region.

- In the U.S., SEC paused access to tokenized stocks due to regulatory restrictions, though Robinhood is seeking clarity via SEC and global directives.

📊 Impact Snapshot of Tokenized U.S. Stocks

- Robinhood stock performance: Up ~13% on launch and +151% YTD in 2025.

- Analyst sentiment: Increased price targets (KeyBanc to $110; Deutsche Bank to $96) after identifying strong revenue potential.

- Competitive field: Robinhood joins Kraken, Coinbase, and Backed Finance—each rolling out tokenized equities under different jurisdictions.

🔮 What’s Next?

- Tokenized stock expansion: Ramp to 2,000+ listings across public and private equities.

- Robinhood blockchain: Full rollout planned later this year—paving way for 24/7 global trading.

- U.S. regulatory outlook: SEC clarity or no-action letters will determine U.S. availability.

- Platform convergence: Expect integration with crypto futures, staking, and DeFi features.

📝 FAQs About Robinhood’s Tokenized US Stocks Offerings

EU regulations allow innovative financial instruments, enabling Robinhood to expand global access to U.S. equities.

There are over 200 U.S. stocks and ETFs, with plans to reach 2,000 by year-end.

Yes—Robinhood distributes real dividends directly within the app.

Yes—each token matches one traditional share. Robinhood-connected broker-dealers hold them in custody.

You can trade tokens 24/5; Robinhood’s native blockchain will enable 24/7 trading once live.

U.S. regulators have not yet authorized tokenized equities; Robinhood is seeking clarification.