In today’s volatile financial landscape, traditional investments no longer satisfy every investor’s needs. Enter Splint Invest—a platform revolutionizing how we approach alternative investments. With investments through tokenization, Splint Invest opens doors once reserved for the wealthy, allowing everyday investors to stake their claim in luxury assets.

A New Era of Accessibility

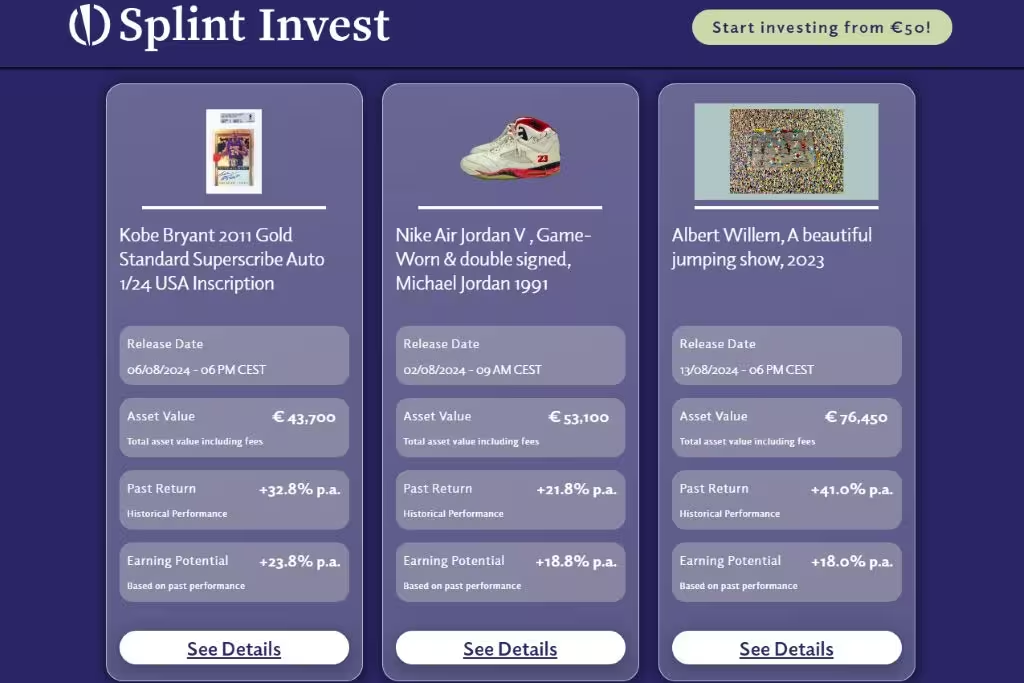

Founded in 2021 and based in Zug, Switzerland, Splint Invest has quickly become a beacon of innovation in the financial world. The platform enables users to invest in tangible assets—luxury watches, rare whiskies, fine art, and more—starting with as little as €50. Through fractional ownership, or “Splints,” investors can diversify their portfolios beyond the stock market’s uncertainties. This democratization of investment aligns perfectly with the growing demand for alternative opportunities.

How Splint Invest Works

The process is simple and transparent. Splint Invest acquires high-value physical assets and divides them into digital shares, known as Splints. Each Splint represents a €50 share in a specific asset. Investors purchase these Splints through an intuitive app, which boasts a seamless onboarding process that takes less than two minutes. Once the asset is sold, investors receive their share of the proceeds, ensuring a straightforward and efficient return on investment.

Positive User Experiences on Splint Invest App

User feedback underscores Splint Invest’s effectiveness. With a 4.9 out of 5 rating on the App Store, the app’s ease of use, detailed asset descriptions, and transparent process receive high praise. Reviewers appreciate the ability to diversify their investments into high-value luxury items with no a substantial initial outlay. The app’s user interface is lauded for its clarity, making it accessible even for those new to alternative investments.

Growth and Expansion for Investments through Tokenization

Since its launch, Splint Invest has seen exponential growth. The platform has facilitated over €11 million in investments, drawing attention not only in Switzerland but also in the UK and Germany. With over 39,000 app downloads and nearly 10,000 active users, Splint Invest is poised to expand further into Europe. Its upcoming Series A financing round aims to accelerate this expansion, reinforcing the platform’s position as a leader in financial innovation.

Ethical Considerations and Financial Inclusivity

Splint Invest doesn’t just offer financial opportunities; it also addresses ethical considerations by promoting financial inclusivity. By lowering the entry barriers to alternative investments, the platform empowers a broader demographic to participate in markets traditionally dominated by affluent individuals. This shift towards inclusivity is vital in an era where economic disparity is a growing concern.

The Look Ahead for Investments through Tokenization

As the alternative investment market continues to evolve, Splint Invest stands at the forefront, leveraging the power of tokenization to reshape the investment landscape. The platform’s success highlights a significant trend—investors are increasingly seeking ways to diversify beyond traditional assets. Splint Invest meets this demand with an innovative, user-friendly solution that opens new possibilities for retail investors.

In conclusion, Splint Invest is more than just an investment platform; it’s a gateway to a new era of financial inclusivity and diversification. By harnessing the power of tokenization, it democratizes access to luxury assets. It offers a secure and straightforward way for individuals to diversify their portfolios and protect their wealth against market volatility. As Splint Invest grows, it will undoubtedly play a pivotal role in shaping the future of investments through tokenization.

Finally, this article has been refined and enhanced by ChatGPT.