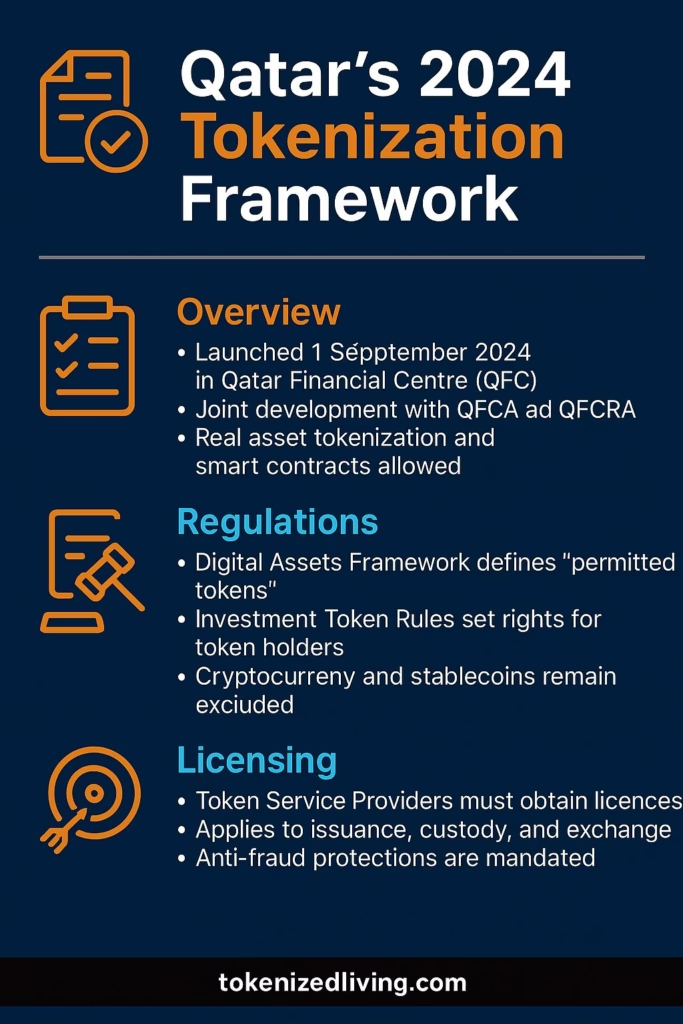

On 1 September 2024, Qatar Central Bank, alongside the Qatar Financial Centre Authority and QFCRA, launched a Digital Assets Framework in the Qatar Financial Centre (QFC). The regime defines “permitted tokens”—investment-grade digital assets backed by real rights, recognizes smart contracts, mandates licensing for Token Service Providers, and excludes cryptocurrencies. This positions Qatar as a regulated hub for tokenization and rising innovation.

“Launching the 2024 Digital Assets Regulations marks a significant milestone in our journey … this framework will create significant opportunities and support establishing a robust regulatory environment.”

— Sheikh Bandar bin Mohammed bin Saoud Al Thani, Governor, Qatar Central Bank

In a significant stride towards financial modernization, the Qatar Central Bank (QCB) has launched its comprehensive digital assets and tokenization framework for 2024. This development follows the recent implementation of Distributed Ledger Technology (DLT) regulations, marking a pivotal moment in Qatar’s financial landscape.

New Tokenization Framework Attracting Global Attention

The newly unveiled framework, developed in collaboration with the Qatar Financial Centre Authority (QFCA) and the Qatar Financial Centre Regulatory Authority (QFCRA), sets the stage for both domestic and international companies to explore opportunities within Qatar’s digital assets ecosystem. Companies interested in pioneering digital asset solutions can now register with the Qatar Digital Assets Lab, fostering an environment ripe for innovation.

New Tokenization Framework and Legal and Regulatory Landscape

The 2024 QFC Digital Assets Framework provides the legal backbone for the creation, regulation, and exchange of digital assets. This framework covers all aspects of asset tokenization, including the legal recognition of property rights, custody solutions, and the seamless transfer and exchange of tokenized assets. Additionally, it acknowledges the legitimacy of smart contracts, ensuring that Qatar’s digital asset ecosystem adheres to the highest global standards.

Collaboration at the Core of Tokenization Framework

This framework is the product of extensive consultation with industry stakeholders. A diverse advisory group, including 37 organizations from the financial, technological, and legal sectors, played a crucial role in shaping these regulations. Furthermore, this collaborative effort underscores Qatar’s commitment to creating a secure, transparent, and competitive digital asset market.

Driving Digital Transformation

Sheikh Bandar bin Mohammed bin Saoud Al Thani, the Governor of Qatar Central Bank, highlighted the significance of the framework, calling it “a major milestone in achieving the Third Financial Sector Strategic Plan.” Moreover, he emphasized the framework’s role in creating opportunities and fostering a robust regulatory environment that aligns with Qatar’s broader digital transformation objectives, as outlined in the Qatar National Vision 2030.

Positioning Qatar as a Global Leader

Yousuf Mohamed Al-Jaida, CEO of QFC, views the Digital Assets Framework as a blueprint for the future of financial services in Qatar. He anticipates that the clarity provided by these regulations will attract a diverse range of players. Thus, further enhancing Qatar’s position as a global hub for digital finance.

Next Steps for the Industry

Following the launch of the framework, companies are now able to apply for licenses to operate as token service providers within the QFC. Therefore, this move is expected to accelerate the growth of the digital asset sector, positioning Qatar as a leader in financial innovation.

Conclusion

The Qatar Central Bank’s launch of the 2024 Digital Assets Framework is more than just a regulatory update. It is a call to innovators worldwide to engage with a forward-thinking financial ecosystem. Finally, as Qatar continues to embrace the digital economy, this framework ensures that the country remains at the forefront of global financial innovation.

❓ FAQ – QFC Digital Assets Framework

It comprises:

Digital Asset Regulations 2024

Investment Token Rules 2024

Token Service Provider Guidelines, along with amendments to existing company and contract regulations.

A token that represents a real-world right or asset—validated by licensed entities and backed by legal documentation. Cryptos and stablecoins remain excluded.

Token Service Providers must obtain licenses to validate, generate, custody, transfer, or exchange investment tokens. Different licensing applies for non-investment tokens.

It’s part of Qatar’s Third Financial Sector Strategic Plan tied to Qatar National Vision 2030. It aims to diversify the economy, attract fintech players, and establish regulated innovation hubs like the QFC Digital Assets Lab.

An advisory group of 37 industry and legal organizations collaborated in drafting the rules. They ensure alignment with global best practices. Over 20 start-ups have already joined the QFC Digital Assets Lab.

Firms interested in tokenization services can now apply for licensing under the QFC regime, with clear obligations around AML/KYC, custody, and disclosures.

We use AI tools to enhance research and drafting, always under human supervision.