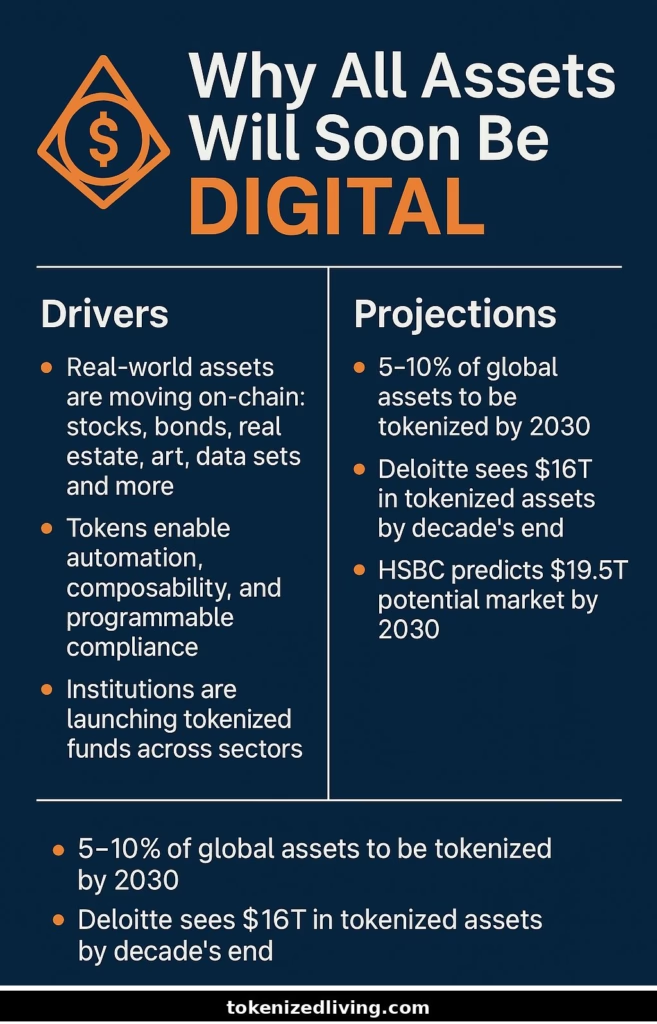

Major institutions predict tokenization will transform 5–10% of global assets into digital tokens by 2030—worth trillions. From real estate and stocks to art and data, nearly every asset class is moving on-chain, driving liquidity, efficiency, and broader access.

“Tokenization … has reached a tipping point … the benefits—including programmability, composability, and enhanced transparency—can empower financial institutions to capture operational efficiencies, increase liquidity, and create new revenue opportunities…”

— McKinsey & Company

The digital transformation is well underway, and one of its most exciting developments is asset tokenization. From real estate to fine art, assets are being brought into the digital world, creating new opportunities for investors and revolutionizing how we think about ownership. But why is this happening, and why does it matter? In this article, we’ll explore why every asset will soon be digital, reshaping the financial landscape.

The Power of Tokenization

Tokenization is the process of converting physical assets into digital tokens that represent ownership on a blockchain. This technology is transformative because it allows assets—whether tangible like property or intangible like stocks—to be easily divided, traded, and transferred online.

One of the greatest advantages of tokenization is accessibility. In traditional markets, investing in assets like real estate or fine art requires significant capital. But with tokenization, fractional ownership allows investors to buy just a portion of an asset. This not only lowers the barrier to entry but also democratizes access to investments previously available only to high-net-worth individuals.

Take real estate as an example. Historically, real estate investments were limited by geographic location and liquidity issues. With tokenization, global investors can now buy digital shares of properties in any country, and these shares can be easily traded on secondary markets. This increases liquidity, making it easier to buy and sell assets without the typical red tape associated with real estate transactions.

Benefits Across Industries

The transition to digital assets is not limited to real estate. Art, commodities, luxury goods, and even intellectual property are being tokenized. This trend is expected to accelerate as more industries realize the benefits of blockchain technology: greater transparency, security, and efficiency.

Art tokenization is particularly promising. Imagine owning a fraction of a Picasso, with your ownership represented by a secure digital token. Not only does this make fine art investments accessible to a wider audience, but it also solves liquidity issues in the art world. This concept of fractional ownership applies across multiple industries, from agriculture to rare collectibles like vintage cars and wines.

Commodities such as gold and oil are also entering the digital realm. Platforms that tokenize these assets are emerging, enabling traders to engage in real-time transactions. This reduces operational costs and eliminates middlemen, allowing markets to operate more efficiently.

Why Now?

The technology for this revolution has been available for a few years. Still, the momentum has been building recently because of a combination of regulatory clarity, increased awareness, and technological advancements. Governments are beginning to embrace digital assets and provide the necessary legal frameworks to protect investors. Meanwhile, platforms like Ethereum have proven that tokenization can be both secure and scalable.

In a world where interoperability is becoming a key focus, the potential for digital assets to move seamlessly between platforms and across borders is creating a global, borderless economy. This ability to trade assets freely, without the constraints of traditional financial systems, is what makes this shift inevitable.

The Future of Digital Assets

As more industries recognize the benefits of tokenization, it’s only a matter of time before every asset becomes digital. Whether you’re an investor looking for opportunities in real estate, a collector interested in fractional ownership of rare art, or a trader looking to expand your portfolio with tokenized commodities, the future is bright. Digital assets offer a more transparent, secure, and efficient way to invest, creating a level playing field for everyone.

The next step is adoption. And with the current pace of innovation, it’s clear that the digital transformation of assets is no longer a far-off possibility—it’s already happening.

❓ FAQ – Why All Assets Will Soon Be Digital

Yes. A joint report by HSBC and Northern Trust forecasts tokenizing 5–10% of all global assets by 2030—equivalent to roughly $19.5 trillion.

Everything—from real estate, art, and classic cars to equities, bonds, commodities, and structured datasets. Fractional tokens make high-value assets accessible to more investors.

More liquidity, lower barriers to entry, faster settlement, automation (via built-in rules), and the ability to program compliance and revenue flows.

Regulatory uncertainty, absence of global standards, technical integration (e.g. oracles), and underdeveloped secondary markets still pose hurdles.

Definitely. Banks like Goldman Sachs, BNY Mellon, and BlackRock are launching tokenized money-market and Treasury funds. Poll data shows institutional interest jumping, with 83% of firms planning to increase digital asset allocations in 2025

Analysts at McKinsey, Deloitte, EY-Parthenon, and others are building consensus that tokenization isn’t theoretical—it’s here. Regulatory engagement continues via the FSB, BIS, and IMF to shape frameworks.

We use AI tools to enhance research and drafting, always under human supervision.