Tokenization is transforming real estate investment, and RealT is at the forefront of this revolution. The RealToken Ecosystem Governance (REG) aims to make tokenization attractive, strategic, and equitable. With numerous use cases, REG forces holders to make strategic choices about their allocation in various ecosystem programs. RealT rewards early adopters and new participants, ensuring long-term commitment and active DAO participation.

Realt are currently fighting a lawsuit brought by the city of Detroit.

The Promise of Tokenization

Tokenization of real assets, or RWAs, represents immense economic potential. Traditional finance giants agree that tokenization is the future of finance, promising significant trading volumes and revenues. RealToken DAO aims to capture a significant share of this market, leveraging its unique position as a pioneer in connecting the real world to decentralized finance.

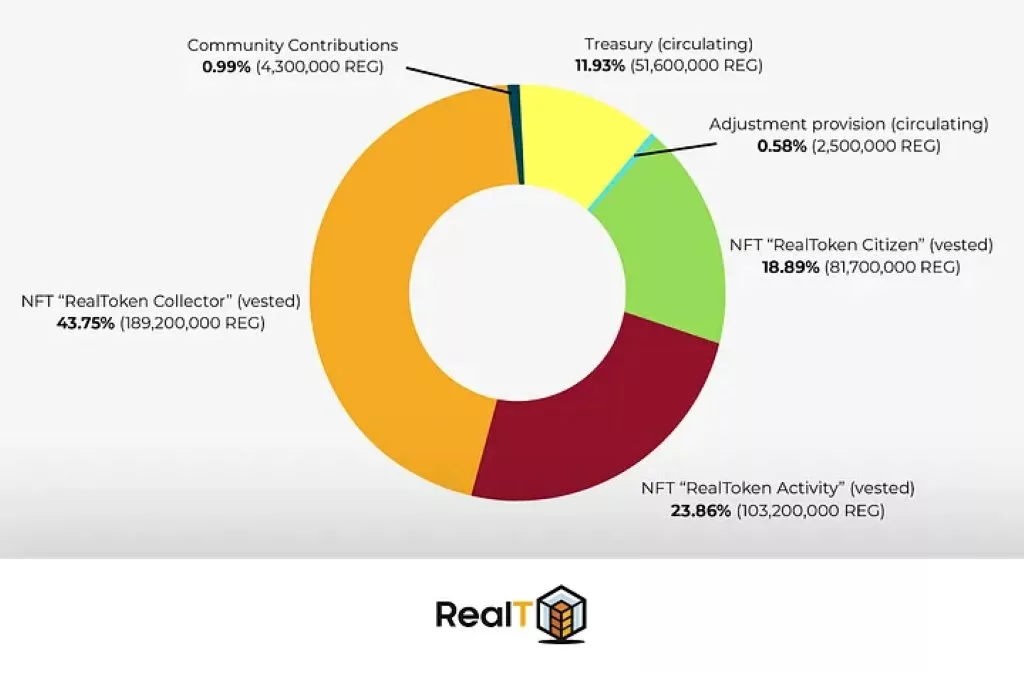

Initial RealToken Ecosystem Governance (REG) Distribution

RealT plans to distribute an initial supply of 500,000,000 REG tokens over five years through airdrops. This process, organized in “epochs” lasting one month each, ensures equitable distribution. RealT designed a dynamic solution offering multiple advantages and balancing everyone’s interests.

Three types of NFTs will determine the allocation criteria among participants:

- RealToken Citizen NFT: Rewards early adopters and focuses on ecosystem citizenship.

- RealToken Activity NFT: Targets active contributors, recognizing both On-Chain and Off-Chain actions.

- RealToken Collector NFT: Aimed at more passive investors with capital to invest.

Holding an NFT boosts voting power, access to airdrops, and other exclusive benefits. The RealToken NFTs make a locked asset liquid without creating a new liquidity pool, avoiding downward pressure on REG’s value.

The Airdrop System

Realt will allocate REG tokens through an innovative airdrop system. Users can access a simulator to estimate their potential REG allocation over the next five years. The system encourages long-term commitment and active participation.

Users must follow a two-step process to withdraw assets from NFTs:

- Register Withdrawal Request: Before the end of the epoch to prevent assets from being locked in for the new epoch.

- Execute Withdrawal: During the following epoch to withdraw the funds.

Each NFT can be resold on the secondary market, generating fees for the DAO and NFT creators. By developing different use cases for the three NFT types, RealT expects increased trading volume and revenue.

DAO’s Role and Future Actions

After distributing the initial supply, the DAO may continue allocating part of its income to replenish NFT budgets, ensuring their long-term viability. By adapting distribution parameters to each epoch, the DAO can encourage various actions to suit the ecosystem’s needs.

RealT distinguishes between the RealToken protocol and the RealT company. RealT, as a service provider commissioned by the DAO, remains free to manage its products and services. It can give additional advantages to NFT holders, like reduced fees on buybacks, enhancing the value proposition for participants.

Conclusion

RealT’s bold decision to allocate 86.5% of its total offering to the ecosystem accelerates decentralization. This strategy ensures fair rewards for early contributors and equal opportunities for newcomers. By aligning economic levers through a balanced distribution, RealT fosters long-term commitment and active participation in the ecosystem.

In conclusion, RealT’s innovative approach to tokenization and its commitment to decentralization position it as a leader in the future of real estate investment. With a dynamic and equitable distribution system, the RealToken Ecosystem Governance (REG), RealT ensures all participants benefit from the ecosystem’s growth and success.

Find out more in our RealT review.

Finally, we refined and enhanced the article using ChatGPT.